Definition Of Equity Premium In Finance

Equity risk premium refers to rate of profit or return that can be earned on financial instruments above the average rate of return. Premium financing is mainly devoted to financing life insurance which differs from property and casualty insurance.

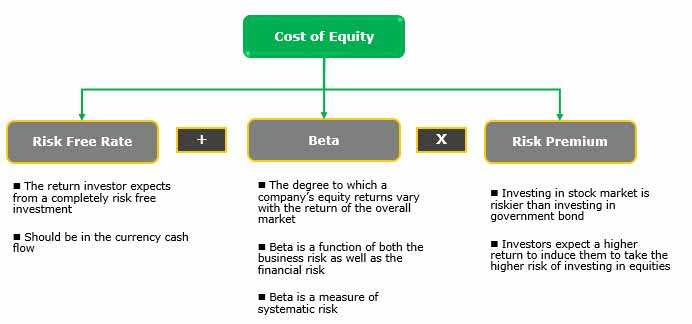

Cost Of Equity Meaning Examples What Is Ke In Capm Ddm

Cost Of Equity Meaning Examples What Is Ke In Capm Ddm

The third datacontains the annual updates that I provide on industry averages for US and global companies on both corporate finance and valuation metrics including multiples.

Definition of equity premium in finance. It is also called cost of common stock or required return on equity. Premium finance loans are often provided by a third party finance entity known as a premium financing company. What is Equity Value.

Cost of Equity Cost of equity k e is the minimum rate of return which a company must earn to convince investors to invest in the companys common stock at its current market price. This excess return compensates investors for taking on the relatively. Premium financing is the lending of funds to a person or company to cover the cost of an insurance premium.

Equity is measured for accounting purposes by subtracting liabilities from the value of the assets. For example if the interest rate on a Treasury bond is 4 and the stock returns 9 the equity risk premium is 5. This regularity dubbed the equity premium puzzle has spawned a plethora.

The return that an investor expects over and above the risk-free rate of return in exchange for investing in common stock instead of US. The equity risk premium may be calculated as the return such a stock actually earns over a given period. How Does an Equity Risk Premium Work.

For example if someone owns a car worth 9000 and owes 3000 on the loan used to buy the car then the difference of 6000 is equity. Generically this amount reflects the risk free rate plus the appropriate equity risk premium. The equity premium puzzle EPP refers to the excessively high historical outperformance of stocks over Treasury bills which is difficult to explain.

In finance equity is ownership of assets that may have debts or other liabilities attached to them. Equity value commonly referred to as the market value of equity or market capitalization Finance CFIs Finance Articles are designed as self-study guides to learn important finance concepts online at your own pace. The premium size depends on the level of risk undertaken on the particular portfolio and the higher the.

The equity risk premium which is usually. To finance a premium. Equity premium the return earned by a risky security in excess of that earned by a relatively risk free US.

The term equity risk premium refers to an excess return that investing in the stock market provides over a risk-free rate. The equity risk premium is the difference between the rate of return of a risk-free investment and the geometric mean return of an individual stock over the same time period. The equity risk premium is an incentive which motivates risky investors to invest in high-risk assets.

However insurance companies and insurance brokerages occasionally provide premium financing services through premium finance platforms. An investors required return on equity or common equity as it is sometimes stated is the total amount of return that an investor will demand in order to make the stock investment that is under consideration. It is also where I provide my estimates of equity risk premiums and costs of capital.

T-bill is an order of magnitude greater than can be rationalized in the context of the standard neoclassical paradigm of financial economics. In simple words Equity Risk Premium is the return offered by individual stock or overall market over and above the risk-free rate of return. Browse hundreds of articles can be defined as the total value of the company that is attributable to equity investors.

Since all investments carry varying degrees of risk the equity risk premium is a measure of the cost of that risk. The equity risk premium may be calculated as the return such a stock actually earns over a given period.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-06-acd73a07b27f4ea38d124481e271fe49.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

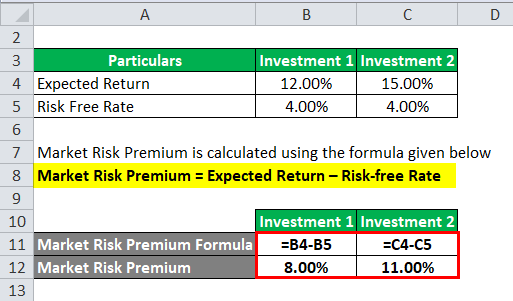

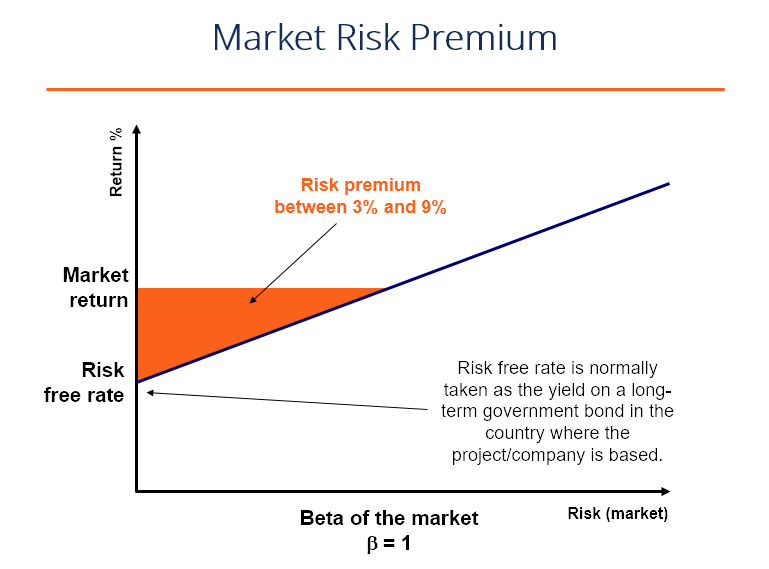

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Definition Example

Market Risk Premium Definition Example

Market Risk Premium Formula Calculator Excel Template

Market Risk Premium Formula Calculator Excel Template

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

Market Risk Premium Definition Example

Market Risk Premium Definition Example

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-03-9dc8f94135ff48b383262fafce26e82f.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

Equity Risk Premium Formula How To Calculate Step By Step

Equity Risk Premium Formula How To Calculate Step By Step

Market Risk Premium Formula Example Required Historical Expected

Market Risk Premium Formula Example Required Historical Expected

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg) What Is The Formula For Calculating Capm In Excel

What Is The Formula For Calculating Capm In Excel

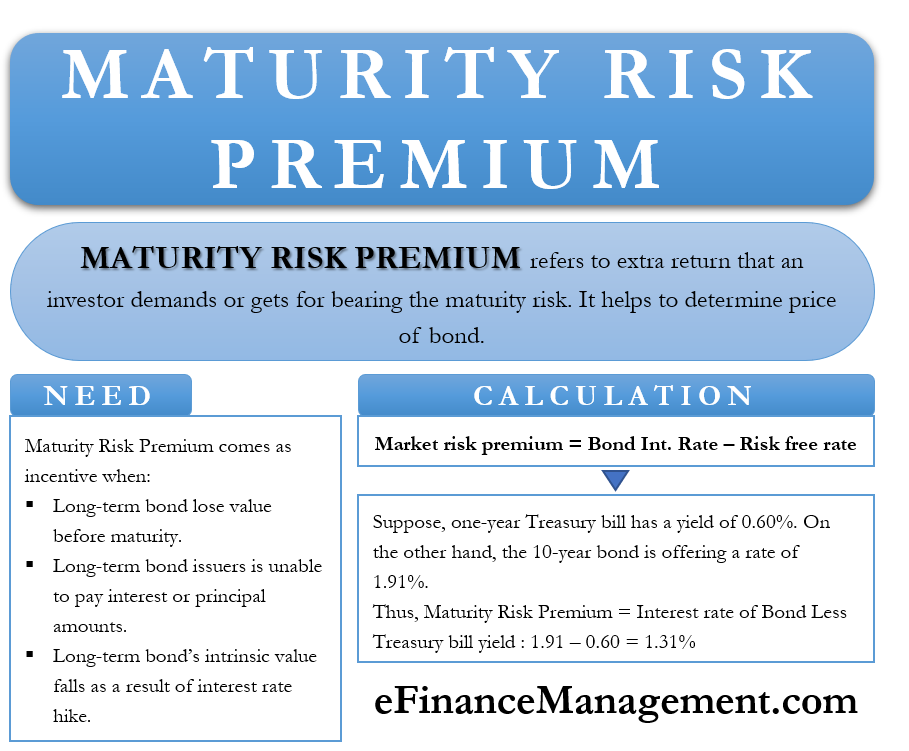

Maturity Risk Premium Meaning Need And Calculation

Maturity Risk Premium Meaning Need And Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-05-7a8167292d2d46409d2828ea87053be2.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

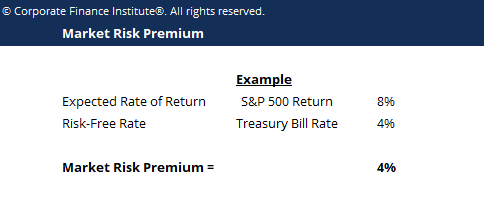

Market Risk Premium Definition Formula And Explanation

Market Risk Premium Definition Formula And Explanation

Market Risk Premium Definition Formula And Explanation

Market Risk Premium Definition Formula And Explanation

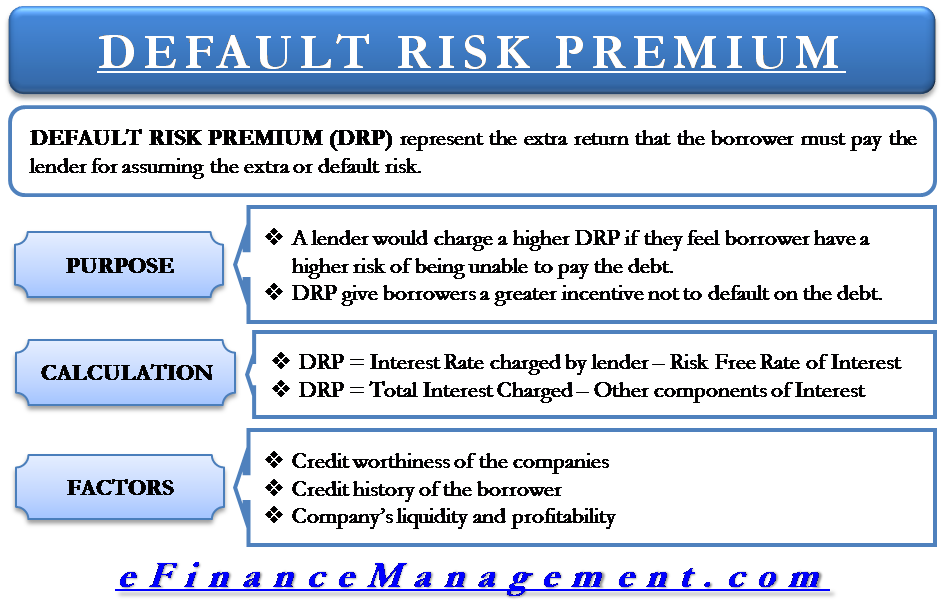

Default Risk Premium Meaning Purpose And Calculation

Default Risk Premium Meaning Purpose And Calculation

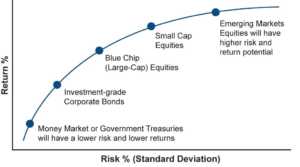

What Is Risk Premium Definition And Meaning Market Business News

What Is Risk Premium Definition And Meaning Market Business News

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

Equity Risk Premium Learn How To Calculate Equity Risk Premiums

Equity Risk Premium Learn How To Calculate Equity Risk Premiums

Post a Comment for "Definition Of Equity Premium In Finance"